Retail Guide: Trends in Grocery Retail

Creating efficiency, empowerment, and convenience for grocery brands and retailers.

*Article updated in 2023We all need to eat.

In 2020, we wrote a piece on grocery retail. We discussed how the pandemic created demand for things such as third-party food delivery services, to-go meal kits, and subscription boxes, and reflected on how restaurant closures, outdoor dining, and at-home cooking affected global food shopping trends.

Through that, the role of the typical grocery store changed. Reduced hours, social distancing, new sanitization practices, inventory disruptions, and fear of the unknown radically shaped how stores handled everything from guest interactions to self-service transactions.

Now, grocery stores must reimagine their store formats to align with cost-conscious, value-driven consumers who are used to certain conveniences and have come to expect different experiences in their local supermarkets.

The remainder of this piece will examine recent grocery store retail trends affecting brands and retailers and provide examples of strategic grocery store display, fixture, and pop-up retail solutions that promote efficiency, empowerment, and convenience in stores.

INDUSTRY INSIGHT:

In the past three years grocery retail has grappled with shifts in consumer demand, attitudes, and spend. From 2020 -2021 these trends were largely affected by things outside of companies’ control, and by 2022 the effects of high inflation and supply chain disturbances only deepened these challenges.

From dramatic price swings to disorganized shopping patterns, ongoing technological advancements to growing consumer consciousness in cost, origin, and ingredients, what used to be normal and widely accepted across grocery retail is now open for interpretation.

As the industry continues to bounce back from “pandemic-buying” - i.e., ” - i.e., purchasing patterns defined by three unique phases: preparedness, extreme, and home-confined - stores attempt to return to a state of homeostasis in the wake of inventory, logistics, labor, safety, financial, and operational issues.

As with other industries, shopping behaviors adopted during the pandemic, such as increased e-commerce and the utilization of curbside pickup, have continued even after the height of the Covid crisis.

Keith Anderson, VP of Strategy at Profitero noted, “Digital commerce advanced eight years in eight weeks…[and] digital grocery sales grew at 4x the rate of brick-and-mortar sales during March and April 2020. ”

This created a unique opportunity for brands, retailers, and consumers to reimagine the role of the grocery store.

Now in 2023…

Stores have re-opened and leading grocery retailers are doing their part to build upon lessons learned over the pandemic. Successful grocery stores are focused on delivering value, keeping costs low, and building store experiences that cater to consumers’ desire for more personalized experiences.

Recently, Grocery Dive released its Grocery Trend report noting the following trends will be important to monitor throughout 2023:

Inflation’s Impacts

Personalization in Cost-savings

Seamless e-commerce Operations (68% of all US shoppers online grocery shop)

Amenity-based omnichannel experiences

Updated store layouts and department experiences

Retail Media Networks Integration (or not)

Private Label Growth

Mergers and Acquisitions

Additionally, industry experts have also noted how consumer curiosity, demand for local products, and the need for more robust grab-and-go formats are shaping the store formats of the future.

Curiosity - a natural byproduct of necessity.

When life gives you lemons, make lemonade. And when the store is out of lemons, sub a lime grab some vodka, and make a spiked limeade!

All kidding aside, as more people stay home and eat out less, many are growing more adventurous in the kitchen. Carryout is expensive, children are picky, and let’s be honest, there’s only so much a frozen meal can really bring to the table. Plus, we’re at home more - it’s not just dinner we have to worry about. It’s breakfast, lunch, and 12 snack breaks in between, too.

The need to experiment is creating demand for new ingredients - especially in fresh produce, meat, seafood, and dairy. However, bakery, deli, and butcher sections of grocery stores were some of the hardest hit during the pandemic due to sanitization concerns (i.e., highest-touch areas). As these sections of stores re-open for service, we will likely see a greater assortment of pre-packaged meals alongside fresh offerings.

“Limited service/assortment and/or shutting down of bakery and deli counters across many stores have had severe negative impact on sales, [however] as retailers learn to adapt and consumers return to in-store shopping there is room for optimism...at the end of the day it will come down to convenience and comfort” (Supermarket News).

Another issue consumers are facing is rising food costs. In particular, meat and seafood have experienced dramatic price increases from both the supply and demand side.

To keep prices down,” notes Seattle-based meat and seafood merchandiser Dave Sanz, “it is more efficient and attractive for supermarkets to source selections closest to their areas.”

Adding more locally-sourced ingredients to grocery stores’ product assortments may help reduce the burden of costly supply-chain disruptions while also appealing to a widely growing consumer preference to shop fresh and local.

On the dairy side of things, Supermarket News reports category management decisions, line extensions, pack size varieties, and number of brands carried/other SKU decisions will be important factors to keep up with fresh dairy product demand.

Whether fruit, vegetable, meat, or dairy product, the challenge will be to reimagine these fresh ingredient spaces as “markets” that cohesively cater to diverse shopping preferences, promote efficiency, and present more intentional product messaging and education to service customers who are looking for new ingredients, preparation methods, and/or meal ideas.

Keeping this in mind, we developed two ideas grocery stores of any size can implement to better serve this growing population of shoppers.

The first sheds light on how to reimagine highly trafficked, in demand areas of stores that may have previously been shutdown or repurposed due to safety and sanitation concerns - such as deli, produce, and meat counters. The goal here is to simplify, streamline attention, and provide intuitive support scenarios to customers’ natural questions, needs, or concerns.

As people venture into stores looking for quick, easy, and safe dinner options, fresh food sections will need more options for pre-packaged and prepared food. The cooler shown features a “weekly” meal idea - correspondent with a weekly circular. Meal accompaniments as well as a complete take-and-go option are both available. Either as a new standalone merchandising element or as inspiration for a reinvention of pre-existing cooler space, attention to how fresh, pre-packaged food is handled is ripe for improvement.

This versatile branded basket rack features the option to showcase a weekly meal idea, sale or promotional item, featured brand or product line, or perhaps educational signage on a specific preparation method, such as “Grilled to Perfection: Time Your Steak Right.” Depending on how the store’s digital operations are setup, a QR code further draws shoppers into an ecosystem of additional content - from videos, promotions, opportunities to earn rewards or loyalty points, and more.

The second idea is founded on the growing demand for a more integrated product selection. As consumers focus on becoming more self-sufficient, environmentally-conscious, and sustainable while also desiring to support local business, it’s only natural that local producers of fruit, vegetables, eggs, milk, honey, baked goods, beer, wine, meat, fish, and other “farmer’s market” items find their way into grocery store lineups on a more consistent basis.

An option to address this scenario is pictured below as an environmental design. In this concept, vacant or unoptimized spaces within a bakery, deli, or produce department could be transformed into a pop-up market that provides local offerings alongside traditional. This “shop-in-shop” family of adaptable display units can be scaled to fit into preexisting environments or used to create a completely new and unique space. Product, messaging, and vendors can rotate with seasons, ensuring consumers keep coming back for the freshest ingredients and the best ideas for what to do with them.

To further carry the idea of localization throughout the store, complementary displays, fixtures, and merchandising elements can be setup throughout that feature items shown in the market in their associated departments. For example, the D’Guy-O homemade salsa brand may make an appearance in center store alongside Frontera, Pace, and Tostitos salsas. As with all proposed units in these ideas, the graphics are easily changed and the displays are easily assembled and scaled. Grocers have max control on what goes where and when.

Notes: if installing and maintaining a local “farmer’s market” still feels a bit like a pipe dream, this type of environmental “market” could simply be used to section out an organic section within a store, creating the feeling of an elevated shopping experience for shoppers.

It also could be used as a pop-up concept at the front of a store to create a sort of “in-and-out-just-the-essentials” area where in demand products (i.e. milk, eggs, bread, toilet paper, seasonal/holiday items, etc.) are readily stocked (pictured below as “5-Minute Market”). To further promote customer convenience, self-check or contactless scan and go can be implemented as well.

Ultimately, the options are endless. Dedicated, streamlined spaces sometimes make cumbersome and overwhelming trips to the grocery store more manageable and enjoyable to shoppers - sentiments we need to protect in this growing age of digital commerce!

Adventuring to the Unknown, and Sometimes Sticking To It

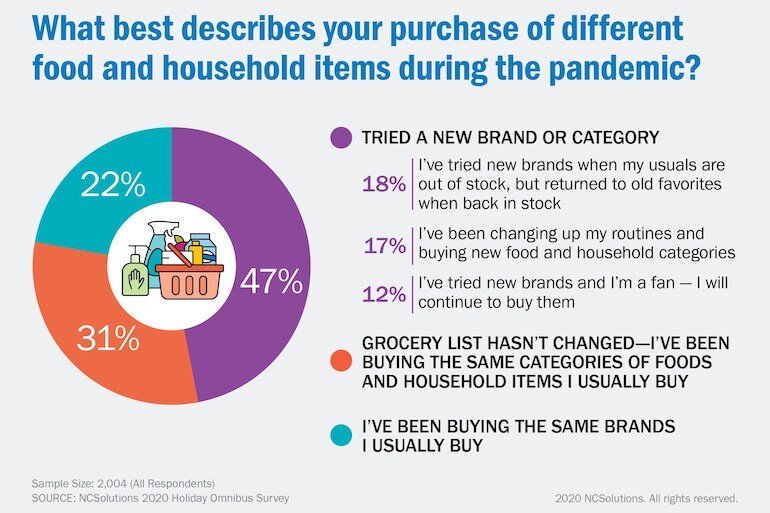

Our preferred brands weren’t always the ones that made it home with us last year. Whether toilet paper or frozen pizza, can of beans or box of cereal, many consumers were pushed to purchase products that weren’t necessarily their preference. For some brands this was a great scenario. For others, namely legacy brands in high demand, this was a less than ideal situation, as some customers who strayed have not come back.

Source: NCSolutions 2020 Holiday Omnibus Survey

Why does this matter? Because at times, uncertainty leads to an open-mind. Brands of all shapes, sizes, and stories have an opportunity to reconsider how they market, merchandise, and stand out in a highly competitive environment. Brand loyalty is no longer a given, especially with younger shoppers who have grown up with more exposure to more options, substitutions, and alternatives than in generations before. Likewise, grocery stores must also find new ways to capture and keep their customers’ loyalty.

Luckily, we have technology on our side. The blending of physical and digital may have taken longer to take off in grocery stores than in some industries, but all bets are pointing to 2021 being the year omnichannel grocery retail strategies truly take hold.

One area technology greatly assists both brands and retailers is in product selection. By incorporating touch, voice, or QR code-activated kiosks throughout stores, shoppers gain access to all the information needed to make a confident purchasing decision with or without the assistance of a store associate.

These kiosks can utilize remotely updated software and content programs that mirror information found on the retailer’s website or weekly circular, including information about sales and promotions, coupons and discounts, or meal planning, recipe, and/or diet and lifestyle ideas. Pricing, inventory levels, similar suggested products, customer reviews, and shopping lists - with aisle wayfinding - can all be generated sight on scene, eliminating the need for shoppers to pull out their smart phones and try to find the information when an employee is not available. Further, these kiosks can also be outfitted with scan and go technology eliminating the need to stand in lengthy check out lines.

To see additional examples of how technology can be used in smart displays and shelves to promote in-aisle visual storytelling + gain more inspiration on how to use form and function as disruption, be sure to check out our Deep Dive into Off-Premise Alcohol Retailing.

Power to the People

It’s no secret that consumer trends drive inventory. One year olive oil is in, the next it’s out - cue an onslaught of associated promotional displays. That’s never going to go away, but now consumer preference seems to be dictating more than product assortment - it’s steering store design and development. Little by little, we’ve seen human-operated cash registers be replaced by self-check or scan and go operations. We’ve watched boring, basic personal care sections become transformed to meet niche needs (think Target and its recently redesigned men’s personal care section or Whole Foods’ Beauty & Body Care layout). Throughout the pandemic, we’ve witnessed entire sections of grocery stores get repurposed to accommodate high demand product categories and have noticed how many seasonal sections transformed into sanitizing stations or curbside delivery processing areas. The average grocery store has a lot of space to work with - it’s time to optimize it for the modern shopper.

While not practical for all formats, one concept worth mentioning is what Hy-Vee did in 2018 with its HealthMarket store of the future. Choosing to view its customers as “patients,” this space melded health, beauty, nutrition, and fitness, and was built to be an extension of its traditional in-store “HealthMarket” section first designed in 2001. According to Grocery Dive, this lifestyle store “offers a pharmacy, medical clinic, sports nutrition center and access to a next-door gym in addition to a lineup of grocery staples, including natural and organic foods, meats and beauty products. There is also a hydration station that offers consumers infused water, kombucha, and nitro coffee.”

Beyond the obvious multi-faceted appeal to a very specific health-conscious customer, this concept made brand partnerships possible in a creative and relevant way. Orange Theory was the gym of choice connected to the space, Capsure hearing aid sponsored a hearing station, and indie-label organic foods, beverages, and supplements could be better promoted in a more succinct and meaningful way - just to name a few.

On a smaller scale, the “store-of-the-future” concept could simply be applied to one department, one section, or even just one aisle of a grocery store to create new drivers for customer interest, attention, and loyalty through display, smart merchandising, product assortments, and elevated service. Diversification breeds relevance.

An example of this can be seen in an update to a traditional personal care and cosmetic section of a grocery store. Though likely not the primary reason for a shopping trip, we know that more people are attempting to consolidate their trips out of the house and adopt a one-and-done approach to shopping. If both bananas and mascara are on a shopping list, let’s do what we can to give both product-types the merchandising attention they deserve and raise customer sentiment, comfort, and overall impression while at it.

For grocery retailers that also have a pharmacy or other health and wellness area, such as a vaccine area, simple changes to aisles, endcaps, and waiting areas can make all the difference. Many of the displays within can easily be repurposed to build out departments focused on customer health, wellness, and personal care needs. For reference, two options are pictured below.

In conclusion:

As we all continue to grow more accustomed to getting what we want, how we want, when we want, with as little as effort as possible (thanks, internet), if there’s anything a grocery store cannot afford to be it’s cumbersome and irrelevant. From both an operational standpoint and a customer sentiment viewpoint, 2020 has given grocery retailers and CPG brands an opportunity to reimagine how they educate, inform, serve, interact with, entertain, delight, and connect to their customers.

Let’s harness the opportunities we have and reimagine grocery store formats as drivers of customer loyalty and satisfaction like we’ve never seen.